About clearing

Clearing is the process of guaranteeing financial market transactions between the execution of the transaction and its settlement. Technically, clearing is the process of establishing positions, including the calculation of net obligations, and ensuring that financial instruments, cash, or both, are available to secure the exposures arising from those positions. Clearing is performed by Central Counterparties (CCPs), which are financial market infrastructures that interpose themselves between the counterparties to the contracts traded on one or more financial markets, becoming the buyer to every seller and the seller to every buyer. Clearing allows counterparties to trade with each other anonymously without worrying about whether their counterparty will honour the trade. In addition, in the event that a counterparty goes bankrupt, clearing allows the market to continue trading without the bankruptcy spreading to other counterparties.

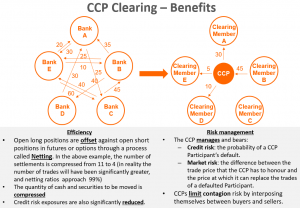

The main benefits of clearing can therefore be summarised as follows:

• Efficiency – CCP Clearing reduces the obligations between counterparties by netting offsetting positions. This netting process reduces counterparty credit risk and liquidity needs between those clearing members involved in those transactions.

•Risk management – CCP Clearing independently manages the risk of counterparties through risk modelling and ensures there are resources available to absorb potential losses that could result from the default of a clearing member, limiting any potential contagion to other CCP participants.